UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of

Contents1934 (Amendment No. )

UNITED STATES

|

SECURITIES AND EXCHANGE COMMISSION

| |

Washington, D.C. 20549

|

|

SCHEDULE 14A

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

Filed by the Registrant x |

|

Filed by a Party other than the Registranto |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)14a‑6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 §240.14a‑12 |

|

| | |

CARE.COM, INC. |

|

| (Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)14a‑6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | |

| (2)

| Aggregate number of securities to which transaction applies: |

| (3) | |

| (3)

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-110‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | |

| (4)

| Proposed maximum aggregate value of transaction: |

| (5) | |

| (5)

| Total fee paid: |

| o | | |

o

| Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | |

| (2)

| Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (3)

(4) | Filing Party:

|

| | |

| (4)

| Date Filed: |

| | |

| | | |

77 Fourth Avenue, 5th FloorWaltham, Massachusetts 02451

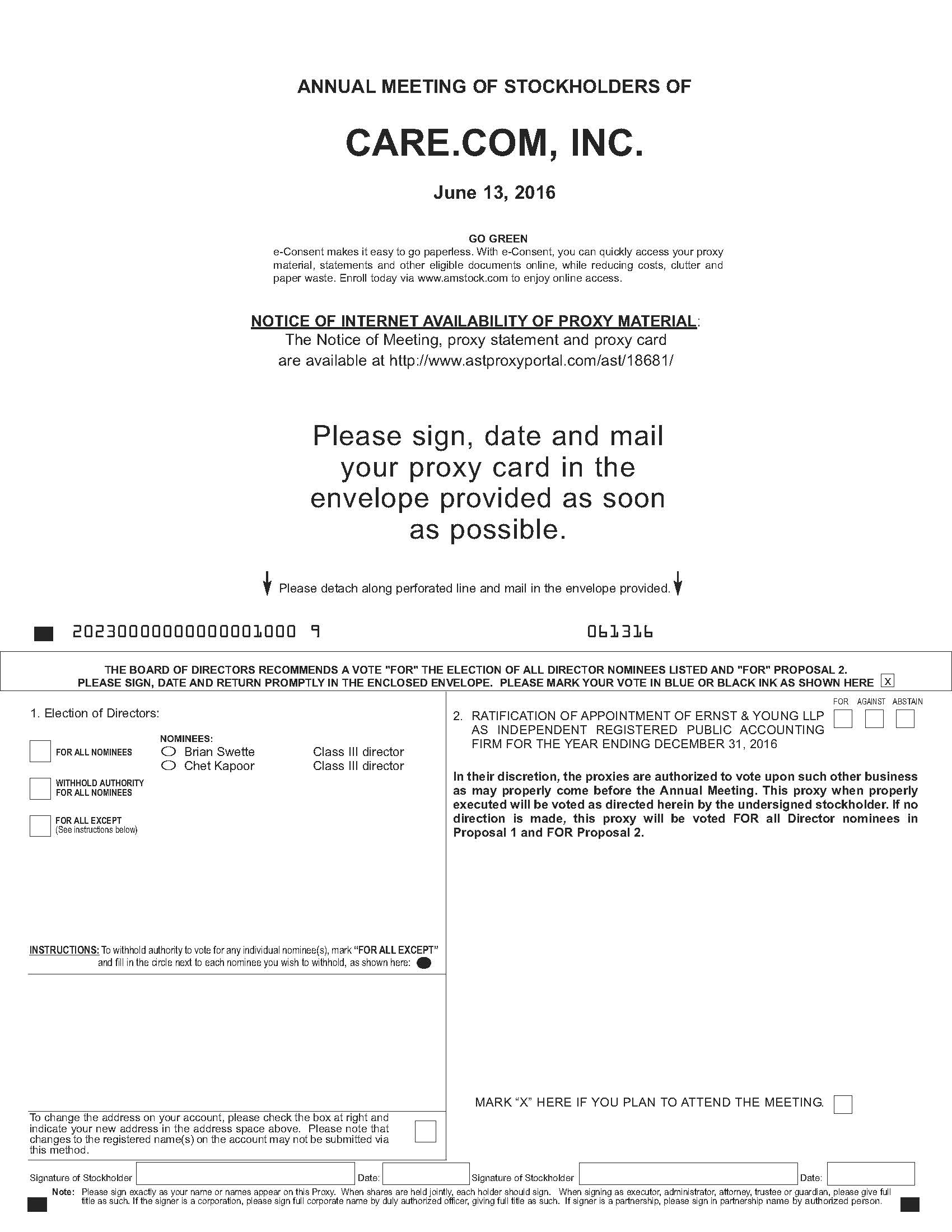

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

MAY 30, 2014JUNE 13, 2016

To the Stockholders of Care.com, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders, or the Annual Meeting, of Care.com, Inc., a Delaware corporation, or the Company, will be held on Friday, May 30, 2014,Monday, June 13, 2016, at 10:00 a.m. local time, at the offices of Latham & Watkins LLP, located in the John Hancock Tower, 20th Floor, 200 Clarendon Street, Boston,77 Fourth Avenue, Lower Level conference room, Waltham, Massachusetts 02116,02451, for the following purposes:1.To elect two Class I directors to hold office until the 2017 annual meeting of stockholders or until their successors are elected;

2.To ratify the selection, by the Audit Committee of the Company’s Board of Directors, of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 27, 2014;

3.To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

| |

| 1. | To elect two Class III directors to hold office until the 2019 annual meeting of stockholders or until their successors are elected; |

| |

| 2. | To ratify the selection, by the Audit Committee of the Company’s Board of Directors, of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2016; |

| |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders who owned the Company’s common stock at the close of business on April 14,

20142016 can vote at this meeting or any adjournments that take place.

The Company’s Board of Directors recommends that you vote FOR the election of the director nominees named in Proposal No. 1 of the Proxy Statement and FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm as described in Proposal No. 2 of the Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials

for the

annual meetingAnnual Meeting of

ShareholdersStockholders To Be Held on

May 30, 2014:June 13, 2016:

the proxy statement and 20142015 annual report are available at

http://www.astproxyportal.com/ast/18681/.

Stockholders may receive directions to attend the meeting in person by calling (781) 795-7244.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION CARD AND RETURN IT AS SOON AS POSSIBLE IN THE ENCLOSED RETURN ENVELOPE, OR VOTE OVER THE INTERNET AS INSTRUCTED ON THE PROXY CARD OR VOTING INSTRUCTION CARD. NO POSTAGE NEED BE AFFIXED IF THE ENCLOSED RETURN ENVELOPE IS MAILED IN THE UNITED STATES. IF YOU RECEIVE MORE THAN ONE PROXY CARD BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY CARD SHOULD BE SIGNED AND RETURNED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED.

|

| |

| By Order of the Board of Directors |

| |

|

|

Waltham, Massachusetts

April 22, 201421, 2016 | Diane M. Musi

General Counsel and Corporate Secretary

|

77 Fourth Avenue

201 Jones Road

Suite 5005th Floor

Waltham, Massachusetts 02451

FOR THE

20142016 ANNUAL MEETING OF STOCKHOLDERS

May 30, 2014

June 13, 2016

We have sent you this Proxy Statement and the enclosed Proxy Card because the Board of Directors, or the Board, of Care.com, Inc. is soliciting your proxy to vote at the Care.com, Inc.

20142016 Annual Meeting of Stockholders, or the Annual Meeting, to be held on

Friday, May 30, 2014,Monday, June 13, 2016, at 10:00 a.m. local time, at

the offices of Latham & Watkins LLP, located in the John Hancock Tower, 20th Floor, 200 Clarendon Street, Boston,77 Fourth Avenue, Lower Level conference room, Waltham, Massachusetts 02116.02451. Except where the context otherwise requires, references to “Care.com,” “the Company,” “we,” “us,” “our,” and similar terms refer to Care.com, Inc.·

This Proxy Statement summarizes information about the proposals to be considered at the Annual Meeting and other information you may find useful in determining how to vote.

·

The Proxy Card is the means by which you actually authorize another person to vote your shares in accordance with your instructions.

In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. All costs of solicitation of proxies will be borne by us. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

We are mailing the Notice of Annual Meeting of Stockholders, this Proxy Statement and Proxy Card to our stockholders of record as of April 14,

2014,2016, or the Record Date, for the first time on or about April

25, 2014.21, 2016. In this mailing, we are also including our Annual Report on Form 10-K for the year ended December

28, 2013,26, 2015, which,

together with the additional cover materials attached thereto, constitutes our

20132015 Annual Report to Stockholders, or the

20132015 Annual Report. In addition, we have provided brokers, dealers, banks, voting trustees and their nominees, at our expense, with additional copies of our proxy materials and the

20132015 Annual Report so that our record holders can supply these materials to the beneficial owners of shares of our common stock as of the Record Date. Our Annual Report on Form 10-K is also available in the “Financial Information

—- SEC Filings” section of our website at investors.care.com.

The only voting securities of Care.com are shares of common stock, $0.001 par value per share, or the common stock, of which there were

30,981,26732,084,261 shares outstanding as of the Record Date (excluding any treasury shares). We need the holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote, present in person or represented by proxy, to establish a quorum for the transaction of business. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

5

Why am I receiving these materials?

We have sent you this Proxy Statement and the enclosed Proxy Card because our Board of Directors is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed Proxy Card or follow the instructions below to submit your proxy over the Internet.

We intend to mail this Proxy Statement and accompanying Proxy Card on or about April

25, 201421, 2016 to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were

30,981,26732,084,261 shares of our common stock issued and outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with the transfer agent for our common stock, American Stock Transfer & Trust Company, LLC, or AST, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed Proxy Card or vote by proxy on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid Proxy Card from your broker or other agent.

What am I being asked to vote on?

You are being asked to vote on two (2) proposals:

6

Table of Contents

·Proposal No. 1—the election of two Class IIII directors to hold office until our 20172019 Annual Meeting of Stockholders; and

·

Proposal No. 2—the ratification of the selection, by the audit committee of our Board, of Ernst & Young LLP as our independent registered public accounting firm for the year ending December

27, 2014.31, 2016.

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

For Proposal 1, you may either vote “FOR” all the nominees to the Board or you may “WITHHOLD” your vote for any nominee you specify or abstain from voting.·

For Proposal 2, you may either vote “FOR” or “AGAINST” or abstain from voting. Please note that by casting your vote by proxy you are authorizing the individuals listed on the Proxy Card to vote your shares in accordance with your instructions and in their discretion with respect to any other matter that properly comes before the Annual Meeting or any adjournments or postponements thereof.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting. Alternatively, you may vote by proxy by using the accompanying Proxy Card or over the Internet. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the Annual Meeting, you may still attend the Annual Meeting and vote in person. In such case, your previously submitted proxy will be disregarded.

·

Voting in Person: To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive.·

Voting by Mail: To vote using the Proxy Card, simply complete, sign and date the accompanying Proxy Card and return it promptly in the envelope provided. If you return your signed Proxy Card to us before the Annual Meeting, we will vote your shares as you direct.·

Voting over the Internet: To vote by proxy over the Internet, follow the instructions provided on the Proxy Card.7

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction card to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

AST has been engaged as our independent agent to tabulate stockholder votes, or Inspector of Elections. If you are a stockholder of record, your executed Proxy Card will be returned directly to AST for tabulation. As noted above, if you hold your shares through a broker, your broker will return one Proxy Card to AST on behalf of all its clients.

Votes will be counted by the Inspector of Elections, who will separately count “For” and (with respect to Proposal 2) “Against” votes, abstentions and broker non-votes. In addition, with respect to the election of directors, the Inspector of Elections will count the number of “Withheld” votes received for the nominees. If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your

shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “routine” items, but not with respect to

“non-routine”“non‑routine” items. See below for more information under the captions “What are

“broker‘broker non-votes?

’” and “Which ballot measures are considered

“routine”‘routine’ and

“non-routine”‘non-routine’?”

What are “broker

non-votes”?non-votes?”

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank, custodian, nominee or other record holder of common stock indicates on a proxy that it does not have discretionary authority to

8

Table of Contents

vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Which ballot measures are considered “routine” or “non-routine?”

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December

27, 201431, 2016 (Proposal 2) is considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal 2. The election of directors (Proposal 1) is considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposal 1.

How many votes are needed to approve the proposal?

With respect to Proposal No. 1, the election of directors, the two Class

IIII director nominees receiving the highest number of votes will be elected. Only votes “For” or “Withheld” will affect the outcome of this proposal.

With respect to Proposal No. 2, the affirmative vote of a majority of votes cast is required for approval. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

What if I return a Proxy Card but do not make specific choices?

If we receive a signed and dated Proxy Card and the Proxy Card does not specify how your shares are to be voted, your shares will be voted “For” the election of each of the two nominees for director, and “For” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your Proxy Card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

9

If you receive more than one set of materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must either sign and return all of the Proxy Cards you receive or follow the instructions for any alternative voting procedure on each of the Proxy Cards.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

·

You may submit another properly completed proxy with a later date.

·

You may send a written notice that you are revoking your proxy to our Corporate Secretary at Care.com, Inc.,

201 Jones Road, Suite 500,77 Fourth Avenue, 5th Floor, Waltham, Massachusetts 02451.

·

You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy.

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by them.

When are stockholder proposals due for next year’s annual meeting of stockholders?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December

19, 2014,22, 2016, to our Corporate Secretary at Care.com, Inc.,

201 Jones Road, Suite 500,77 Fourth Avenue, 5th Floor, Waltham, Massachusetts 02451; provided that if the date of the annual meeting is more than 30 days from

May 30, 2015,June 13, 2017, the deadline is a reasonable time before we begin to print and send our proxy materials for next year’s annual meeting. If you wish to submit a proposal that is not to be included in our proxy materials for next year’s annual meeting pursuant to the shareholder proposal procedures of the Securities and Exchange Commission, or the

SEC.SEC, or to nominate a director, you must do so between

December 19, 2014February 13, 2017 and

January 18, 2015;March 15, 2017; provided that if the date of that annual meeting is more than 30 days before or more than 60 days after

May 30, 2015,June 13, 2017, you must give notice not later than the 90th day prior to the annual meeting date or, if later, the 10th day following the day on which public disclosure of the annual meeting date is first made. You are also advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority in voting power of the shares of our common stock issued and outstanding and entitled to vote are present in person or represented by proxy at the Annual Meeting. On the Record Date, there were

30,981,26732,084,261 shares outstanding and entitled to vote.

10

Table of Contents

Accordingly, 15,490,63416,042,131 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy or vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairperson of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in person or represented by proxy, may adjourn the Annual Meeting to another time or place.

How can I find out the results of the voting at the Annual Meeting?

We will announce voting results by filing a Current Report on Form 8-K with

the Securities and Exchange Commission, or the SEC within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K with the SEC within four business days after the day the final results are available.

Implications of being an “emerging growth

company”.company.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements. These reduced reporting requirements include reduced disclosure about the Company’s executive compensation arrangements and do not require us to hold non-binding advisory votes on executive compensation. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.11

Our Board of Directors, or the Board, is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term.

At each annual meeting of stockholders, the successors to directors whose terms will then expire will be elected to serve from the time of election and qualification until the third subsequent annual meeting of stockholders. Unless the Board determines that vacancies (including vacancies created by increases in the number of directors) shall be filled by the stockholders, and except as otherwise provided by law, vacancies on the Board may be filled only by the affirmative vote of a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified.

The Board currently consists of seven directors, divided into the three classes:

·

Class I directors: Sheila Lirio Marcelo and Steven Cakebread, whose current terms will expire at the Annual Meeting;·Class II directors: Tony Florence, J. Sanford Miller and Antonio Rodriguez,I. Duncan Robertson, whose current terms will expire at the annual meeting of stockholders to be held in 2015; and2017;

·

Class IIIII directors: Brian SwetteTony Florence and Amanda Ginsberg,J. Sanford Miller, whose current terms will expire at the annual meeting of stockholders to be held in 2016.2018; andAt each annual meeting of stockholders, the successors to

Class III directors: Brian Swette, Laura Lang and Chet Kapoor, whose current terms will then expire at the Annual Meeting.

Ms. Lang has announced her intention to retire from the Board upon the expiration of her term at the Annual Meeting. Accordingly, the size of the Board will be electedreduced to serve fromsix directors as of immediately following the timeAnnual Meeting to reflect the number of electiondirectors then serving on the Board. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Brian Swette and

qualification until the third subsequent annual meeting of stockholders.Sheila Lirio Marcelo and Steven CakebreadChet Kapoor have been nominated to serve as Class IIII directors and have agreed to stand for reelection. Each director to be elected will hold office from the date of his or her election by the stockholders until the third subsequent annual meeting of stockholders or until her or his successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two Class

IIII director nominees named above. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. Directors are elected by a plurality of the votes cast at the meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE ELECTION OF EACH NAMED NOMINEE.12

Table of Contents

The following table sets forth, for the Class IIII nominees (who are currently standing for re-election)re‑election) and for our other current directors who will continue in office after the Annual Meeting, information with respect to their ages and position(s)/office(s) held within the Company as of the date of this Proxy Statement:

Name | | Age | | Position/Office Held With the Company | | Director

Since | |

Class I Directors whose terms expire at the Annual Meeting | | | |

Sheila Lirio Marcelo(1) | | 43 | | Founder, President, Chief Executive Officer and Director | | 2006 | |

Steven Cakebread(2) | | 62 | | Director | | 2013 | |

Class II Directors whose terms expire at the 2015 Annual Meeting of Stockholders | | | |

Tony Florence(2)(3) | | 45 | | Director | | 2010 | |

J. Sanford Miller(2)(4) | | 64 | | Director | | 2012 | |

Antonio Rodriguez(3)(4) | | 39 | | Director | | 2012 | |

Class III Directors whose terms expire at the 2016 Annual Meeting of Stockholders | | | |

Brian Swette(3)(5) | | 60 | | Director | | 2007 | |

Amanda Ginsberg | | 44 | | Director | | 2012 | |

|

| | | | | |

| Name | | Age | Position/Office Held With the Company | Director Since |

| Class I Directors, whose terms expire at the 2017 Annual Meeting of Stockholders |

Sheila Lirio Marcelo(1) | 45 | Founder, President, Chief Executive Officer and Director | 2006 |

|

I. Duncan Robertson(2) | 49 | Director | 2014 |

|

| Class II Directors, whose terms expire at the 2018 Annual Meeting of Stockholders |

Tony Florence(2)(3)(4) | 47 | Director | 2010 |

|

J. Sanford Miller(2)(4) | 66 | Director | 2012 |

|

| Class III Directors, whose terms expire at the Annual Meeting |

Brian Swette(3)(5) | 62 | Director | 2007 |

|

| Chet Kapoor | 41 | Director | 2016 |

|

| | | | | |

(2)Member of the audit committee. (3)Member of the compensation committee. (4)Member of the nominating and corporate governance committee. (5)Lead independent director.

Set forth below is biographical information, as of the date of this Proxy Statement, for the Class

IIII director nominees and each person whose term of office as a director will continue after the Annual Meeting. The following includes certain information regarding our directors’ individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as directors.

Nominees for Election to a Three-Year Term Expiring at

Directors Continuing in Office Until the 2017 Annual Meeting of Stockholders

Sheila Lirio Marcelo is our founder and has served as our President and Chief Executive Officer and a director since October 2006. Ms. Marcelo has served as the chairmanchairwoman of the Board since October 2011. Prior to founding Care.com in 2006, Ms. Marcelo was an Entrepreneur-in-Residence at Matrix Partners, a venture capital firm, for six months. From 2005 to the beginning of 2006, Ms. Marcelo served as Vice President and General Manager of TheLadders.com, an online job matching service. Before joining TheLadders.com, Ms. Marcelo spent five years at Upromise, Inc., an online service that helps families save for college, where she held various executive positions, including Vice President, Product Management and Marketing. Earlier in her career, Ms. Marcelo was a consultant for Monitor Group and Pyramid Research, and she began her career as an analyst at Putnam, Hayes & Bartlett. Ms. Marcelo graduated from Mount Holyoke College with a degree in economics and received her M.B.A. and J.D. from Harvard13

Table of Contents

University. We believe Ms. Marcelo is qualified to serve on the Board due to the perspective, leadership and operational experience she brings as our Chief Executive Officer, as well as the vision and continuity she brings as our founder.

Steven CakebreadI. Duncan Robertson has served as a member of the Board since December 2013.November 2014. Mr. Cakebread currentlyRobertson serves since March 2013, as Senior Vice President, Chief Accounting Officer and Chief Financial Officer of D-Wave Systems Inc., a quantum computer manufacturer. From March 2010 to December 2012,Paxion Capital, LP, an investment fund, which he joined in June 2015. Previously, Mr. CakebreadRobertson served as Executive Vice President and Chief Financial Officerchief financial officer of Pandora Media,OpenTable, Inc., a provider of Internet radio. From February 2009online restaurant reservations, from August 2011 to August 2009,October 2014. Mr. CakebreadRobertson served as Senior Vice President and Chief Accounting Officerchief financial officer of Xactly Corporation,SnapStick, Inc., a provider of on-demand sales performance management software. From February 2008mobile application software company, from May 2010 to January 2009,July 2011. Prior to SnapStick, Mr. CakebreadRobertson served as President and Chief Strategy Officerchief financial officer of Salesforce.com,Aricent Inc., a customer relationship management service provider,technology services company, from June 2005 to June 2009, and as Executive Vice Presidentvice president finance and Chief Financial Officer of Salesforce.cominvestor relations at Flextronics, Inc., an electronic manufacturing services provider, from May 2002 to February 2008. Mr. Cakebread currently serves on the boards of directors of SolarWinds, Inc. and ServiceSource International LLC, as well as several private companies. Mr. Cakebread also previously served on the board of directors of eHealth, Inc. from June 2006October 2001 to June 2012.2005. Mr. Cakebread holdsRobertson is a B.S. in Businessmember of the Board of Trustees of The San Francisco Foundation, is a Chartered Accountant and has a Bachelor of Commerce degree from the University of California at BerkeleyCape Town and an M.B.A. from Indiana University.the University of Chicago Booth School of Business. We believe Mr. CakebreadRobertson is qualified to serve on the Board due to his extensive financial, operationalbackground with consumer Internet, mobile and senior managementtechnology companies, and his experience with both publicbuilding and private companies.scaling online marketplaces.

Directors Continuing in Office Until the

20152018 Annual Meeting of Stockholders

Tony Florence has served as a member of the Board since October 2010. Mr. Florence is a General Partner of New Enterprise Associates, or NEA, a venture capital firm, where he co-leads the firm’s consumer Internet investment practice and venture growth equity efforts. Mr. Florence currently serves as a director of Cvent, Inc., a provider of online

software for event management, web surveys and email marketing. Mr. Florence also currently serves on the boards of several private companies. Prior to joining NEA in 2008, Mr. Florence spent 14 years at Morgan Stanley, most recently as a Managing Director and Head of Technology Banking in New York. Mr. Florence holds an M.B.A. and an A.B. in Economics from Dartmouth College. We believe Mr. Florence is qualified to serve on the Board due to his broad investment experience in the consumer Internet industry.

J. Sanford (Sandy) Miller has served as a member of the Board since August 2012. Since 2006, Mr. Miller has been a General Partner of Institutional Venture Partners, or IVP, a venture capital firm, where he focuses on later-stage venture and growth equity investments in technology, Internet and digital media companies. Mr. Miller currently serves as a director of On Deck Capital, Inc., a financial technology company. Mr. Miller served as a director of Vonage, a provider of broadband phone services, from 2004 to May 2011 and as a director of FleetMatics, a provider of GPS tracking applications for commercial fleets, from November 2010 to August 2013. Mr. Miller also currently serves as a director of several private companies. Prior to joining IVP in 2006, Mr. Miller was a Senior Partner with 3i, a venture capital firm, from 2001 to 2006. Earlier in his career, Mr. Miller was a technology investment banker, management consultant and corporate lawyer. Mr. Miller holds a B.A. from the University of Virginia and an M.B.A. and a J.D. from Stanford University. We believe Mr. Miller is qualified to serve on the Board due to his14

Table of Contents

extensive background in the private equity industry and his servicegovernance experience having served on the boards of directors of many public and private companies.

companies, particularly in the technology, Internet and digital media industries.

Antonio Rodriguez has served asNominees for Election to a member ofThree-Year Term Expiring at the Board since December 2012. Mr. Rodriguez is a General Partner at Matrix Partners, a venture capital firm, where he focuses on consumer Internet, mobile, software and Internet infrastructure companies. Mr. Rodriguez currently serves as a director of several private companies. Prior to joining Matrix in 2010, Mr. Rodriguez was Chief Technology Officer of the Consumer Imaging and Printing Division at HP, a global technology company, from 2007 to 2010. Prior to that, Mr. Rodriguez was the Founder and Chief Executive Officer of Tabblo, a high-end photo site, from 2005 until its acquisition by HP in 2007. Mr. Rodriguez holds an A.B. from Harvard University and an M.B.A. from the Stanford Graduate School of Business. We believe Mr. Rodriguez is qualified to serve on the Board due to his extensive operational, senior management and board experience with consumer Internet, mobile and software companies.Directors Continuing in Office Until the 20162019 Annual Meeting of Stockholders

Brian Swette has served as a member of the Board since May 2007 and as our lead independent director since December 2013. Mr. Swette has served as Chairman of Sweet Earth Natural Foods, a natural foods company, since September 2011 and as its President since September 2012. Mr. Swette currently serves as a director of Jamba, Inc., owner and franchisor of Jamba Juice beverage and food offerings, and Shutterfly, a retailer of personalized products and services. Mr. Swette previously served on the board of directors of Schiff Nutrition International, a nutritional supplement company, from November 2011 until its acquisition by Reckitt Benckiser Group in October 2012. Mr. Swette also previously served on the board of directors of Jamba, Inc., owner and franchisor of Jamba Juice beverage and food offerings, from 2007 to 2014, and Burger King Holdings, Inc. from 2002 to 2010. From 1998 to 2002, Mr. Swette served as eBay’s Chief Operating Officer where he oversaw the company’s international expansion, marketing and customer support. Prior to joining eBay, Mr. Swette spent 17 years at PepsiCo, including four years as Executive Vice President and Chief Marketing Officer from 1994 to 1998 where he was responsible for the worldwide marketing and advertising efforts for all Pepsi-Cola brands. Mr. Swette holds a bachelor’s degree in economics from Arizona State University. We believe Mr. Swette is qualified to serve on the Board due to his extensive operational, senior management and board experience with public and private consumer products and Internet companies.

Amanda Ginsberg Chet Kapoorhas served as a member of the Board since February 2012. Ms. GinsbergMarch 2016. Mr. Kapoor was appointed to the Board pursuant to an Agreement, dated as of March 11, 2016, among the Company, Tenzing Global Management LLC, Tenzing Global Investors LLC, Tenzing Global Investors Fund I LP and Chet Kapoor. For more information, see “Corporate Governance - Nomination and Standstill Agreement and Appointment of Chet Kapoor to the Board of Directors.” There is no other agreement or understanding between Mr. Kapoor and any other person pursuant to which he was appointed to the Board. Since 2011, Mr. Kapoor has been the Managing Partner, Co-Founder and Portfolio Manager of Tenzing Global, a San Francisco-based investment manager focused on value investments in the technology, media telecommunications and consumer sectors. Prior to founding Tenzing Global, Mr. Kapoor served as a Managing Partner and Head of Equities at Perry Capital, where he led a team of ten professionals to invest in technology, media, telecommunications, healthcare and consumer stocks. Mr. Kapoor was employed by Perry Capital from 2004 to 2010. Mr. Kapoor was an Associate at Blum Capital in San Francisco from 2000 to 2002, where he focused on value investing across several industries. He began his career as a Financial Analyst in investment banking with CS First Boston. Mr. Kapoor currently serves as Chief Executive Officera director of Tutor.com,Brightcove, Inc. Mr. Kapoor holds a provider of on-demand instructional solutions for studentsB.S. in Mechanical Engineering and professionals. Prior joining Tutor.com,a B.A. in English from January 2012 until May 2013 Ms. Ginsberg servedRice University, as Chief Executive Officer of Match.com, an online dating website, andwell as President of Match.com North America from 2006 to 2012. Ms. Ginsberg also served as Vice President and General Manager for Match.com’s sister site, Chemistry.com, from 2006 to 2008. Ms. Ginsberg holds an undergraduate degree from the University of California at Berkeley and an M.B.A. from The Wharton School of Business at the University of Pennsylvania.Stanford University. We believe Ms. GinsbergMr. Kapoor is qualified to serve on the Board due to her extensive operational and senior managementhis significant investment experience with consumer Internettechnology companies.15

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of the Board has engaged Ernst & Young LLP as our independent registered public accounting firm for the year ending December

27, 2014,31, 2016, and is seeking ratification of such selection by our stockholders at the Annual Meeting. Ernst & Young LLP has audited our financial statements since the year ended December 31, 2007. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

The audit committee annually reviews the independent registered public accounting firm’s independence, including reviewing all relationships between the independent registered public accounting firm and us and any disclosed relationships or services that may impact the objectivity and independence of the independent registered public accounting firm, and the independent registered public accounting firm’s performance. Neither our bylaws nor other governing documents or law require stockholder ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm. However, the audit committee is submitting the selection of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the audit committee will reconsider whether or not to retain Ernst & Young LLP. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

Principal Accountant Fees and Services

The following table provides information regarding the fees incurred to Ernst & Young LLP during the years ended December

31, 201227, 2014 and December

28, 2013. | | Year Ended | |

| | December

31,

2012 | | December

28,

2013 | |

Audit Fees(1) | | $ | 285,313 | | $ | 2,066,980 | |

Audit-Related Fees(2) | | 28,650 | | — | |

Tax Fees(3) | | 68,885 | | 78,400 | |

All Other Fees(4) | | — | | 1,995 | |

Total Fees | | $ | 382,848 | | 2,147,375 | |

| | | | | | | |

(1)Audit fees consist of aggregate fees for professional services provided in connection with the annual audit of our consolidated financial statements, the review of our quarterly condensed consolidated financial statements, consultations on accounting matters directly related to the audit, and comfort letters, consents and assistance with and review of documents filed with the SEC.

16

|

| | | | | | |

| | Year Ended |

| | December 26,

2015 | December 27,

2014 |

| Audit Fees(1) |

| $1,117,230 |

|

| $1,241,860 |

|

| Audit‑Related Fees(2) | - |

| - |

|

| Tax Fees(3) | 65,500 |

| 102,000 |

|

| All Other Fees(4) | 1,820 |

| 2,300 |

|

| Total Fees |

| $1,184,550 |

|

| $1,346,160 |

|

| |

| (1) | Audit fees consist of aggregate fees for professional services provided in connection with the annual audit of our consolidated financial statements, the review of our quarterly condensed consolidated financial statements, consultations on accounting matters directly related to the audit, and comfort letters, consents and assistance with and review of documents filed with the SEC. |

| |

| (2) | During the years ended December 27, 2014 and December 26, 2015, there were not audit-related fees. |

| |

| (3) | Tax fees consist of aggregate fees for tax compliance, tax advice and tax planning services including the review and preparation of our federal and state income tax returns. |

| |

| (4) | Consist of aggregate fees billed for products and services provided by the independent registered public accounting firm other than those disclosed above. These fees consisted of fees for access to Ernst & Young’s online accounting research tool. |

Table of Contents

(2)Audited related fees consist of aggregate fees for accounting consultations and other services that were reasonably related to the performance of audits or reviews of our consolidated financial statements and were not reported above under “Audit Fees”.

(3)Tax fees consist of aggregate fees for tax compliance, tax advice and tax planning services including the review and preparation of our federal and state income tax returns.

(4)Consist of aggregate fees billed for products and services provided by the independent registered public accounting firm other than those disclosed above. These fees consisted of fees for access to Ernst & Young’s online accounting research tool.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit committee adopted, and our board of directors ratified, a policy that became effective upon the closing of our initial public offering in January 2014 under which the audit committee must pre-approve all audit and permissible non-audit services to be provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval would generally be requested

annually, with any pre-approval detailed as to the particular service, which must be classified in one of the four categories of services listed above. The audit committee may also, on a case-by-case basis, pre-approve particular services that are not contained in the annual pre-approval request. In connection with this pre-approval policy, the audit committee also considers whether the categories of pre-approved services are consistent with the rules on accountant independence of the SEC and the Public Company Accounting Oversight Board. The audit committee has pre-approved all services performed since our policy on pre-approval of audit and non-audit services was adopted.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THIS PROPOSAL NO. 2.

17

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of Care.com, Inc. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

The primary purpose of the audit committee is to assist our board of directors in its oversight of our financial reporting processes, our accounting policies and procedures, and our financial and accounting controls. The audit committee’s functions are more fully described in its charter, which is available on our website at investors.care.com.

Management has the primary responsibility for our financial statements and reporting processes, including our systems of internal controls. Ernst & Young LLP (“Ernst & Young”), our independent registered public accounting firm for

2013,2015, was responsible for performing an independent audit of our

20132015 consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles.

The audit committee has reviewed and discussed with management our audited financial statements for the year ended December

28, 2013.26, 2015. In addition, the audit committee has met with Ernst & Young, with and without management present, to discuss the overall scope of Ernst & Young’s audit, the results of its audits and the overall quality of Care.com’s financial reporting.

The audit committee has also discussed with Ernst & Young the matters required to be discussed by Statement on Auditing Standards No. 114 regarding “The Auditor’s Communication With Those Charged With Governance” and by Auditing Standard No. 16 adopted by the Public Company Accounting Oversight Board (United States) regarding “Communication with Audit Committees.” The audit committee also has received and reviewed the written disclosures and the letter from Ernst & Young required by applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young’s communications with the audit committee concerning independence, and has discussed with Ernst & Young its independence from us.

Based on the review and discussions referred to above, the audit committee recommended to Care.com’s board of directors that the Company’s audited financial statements be included in Care.com’s Annual Report on Form 10-K for the fiscal year ended December

28, 2013.26, 2015.

The audit committee has engaged Ernst & Young

LLP as our independent registered public accounting firm for the fiscal year ending December

27, 201431, 2016 and is seeking ratification of such selection by the stockholders.

|

|

|

| Audit Committee

Steven CakebreadI. Duncan Robertson (Chairman)

Tony Florence

J. Sanford Miller |

18

Code of Business Conduct and Ethics

The Board has adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The code is posted under the “Corporate Governance

—– Governance Documents” section of our website, investors.care.com. In addition, we intend to post on our website all disclosures that are required by law or the New York Stock Exchange, or NYSE, listing standards concerning any amendments to, or waivers from, any provision of the

code..code.

Corporate Governance Guidelines

We believe in sound corporate governance practices and have adopted formal Corporate Governance Guidelines to enhance our effectiveness. The Board adopted these Corporate Governance Guidelines in order to ensure that it has the necessary practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The Corporate Governance Guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the practices the Board follows with respect to, among other things, Board and committee composition and selection, director independence, Board meetings, Chief Executive Officer performance evaluation and succession planning for the Chief Executive Officer. A copy of our Corporate Governance Guidelines is available under the “Corporate Governance

—– Governance Documents” section of our website, investors.care.com.

Independence of the Board of Directors

The Board has determined that all of our directors, other than Ms. Marcelo, qualify as “independent” directors in accordance with the listing requirements of the NYSE. Ms. Marcelo is not considered independent because she is an employee of Care.com. The NYSE independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of such director’s family members has engaged in various types of business dealings with us. In addition, as required by NYSE rules, the Board has made a subjective determination as to each independent director that no relationships exist

which,that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors or executive officers.

19

The Board is currently chaired by Sheila Lirio Marcelo, our President and Chief Executive Officer. In December 2013, the Board established the position of lead independent director and elected Brian Swette as lead independent director. Our amended and restated by-laws and

corporate governance guidelinesCorporate Governance Guidelines provide the Board with flexibility to combine or separate the positions of Chairman of the Board and Chief Executive Officer and/or utilize a lead director in accordance with its determination that one or the other structure would be in the best interests of our company. The Board has concluded that our current leadership structure is appropriate at this time. However, the Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Role of Board in Risk Oversight Process

Risk assessment and oversight are an integral part of our governance and management processes. The Board encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of

the risks facing us. Throughout the year, senior management reviews these risks with the Board at regular board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of the Board that address risks inherent in their respective areas of oversight. In particular, the Board is responsible for monitoring and assessing strategic risk exposure and our audit committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The audit committee also monitors compliance with legal and regulatory requirements and considers and approves or disapproves any related person transactions. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Our nominating and governance committee monitors the effectiveness of our corporate governance guidelines.

Our audit committee oversees our corporate accounting and financial reporting process. Among other matters, the audit committee:

·

appoints and determines the compensation and retention of our independent registered public accounting firm;

·

evaluates the independent registered public accounting firm’s qualifications, independence and performance;

20

Table of Contents

·determines the engagement of the independent registered public accounting firm;

·

reviews and approves the scope of the annual audit and the audit fee;

·

discusses with management and the independent registered public accounting firm the results of the annual audit and the review of our quarterly financial statements;

·

approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services;

·

reviews our financial statements and our management’s discussion and analysis of financial condition and results of operations to be included in our annual and quarterly reports to be filed with the SEC;

and·

establishes policies and procedures for the receipt, retention and treatment of accounting-related complaints and

concerns:·concerns;

prepares the audit committee report required by SEC rules to be included in our annual proxy statement; and

·

reviews and evaluates, at least annually, the audit committee charter and the committee’s performance.

The members of our audit committee are Messrs.

Cakebread,Robertson, Florence and Miller, with Mr.

CakebreadRobertson serving as chairperson of the committee. The Board has determined that each of these members is an independent director under NYSE rules and under Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Each of these members meets the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. The Board has determined that Mr.

CakebreadRobertson is an “audit committee financial expert” as defined by applicable SEC rules and has the requisite accounting or related financial management expertise as defined under the applicable NYSE rules and regulations. A current copy of the audit committee charter is available in the “Corporate Governance

—– Governance Documents” section of our website at investors.care.com.

The compensation committee’s responsibilities include:

·

reviewing and recommending policies relating to compensation and benefits of our executive officers;

·

reviewing and approving corporate goals and objectives relevant to

the compensation of our Chief Executive Officer and determining (either alone or, if directed by the Board, in conjunction with a majority of the independent directors on the Board) our Chief Executive Officer’s compensation;

·

reviewing and setting or recommending to the Board the compensation of our executive officers other than our Chief Executive Officer;

·

reviewing and approving or recommending to the Board the issuance of stock options and other awards under our stock plans;

·

reviewing and making recommendations to the Board with respect to director compensation;

·

appointing, compensating and overseeing the work of any compensation consultant or other advisor retained by the committee; and

·

reviewing and evaluating, at least annually, the compensation committee charter and the committee’s performance.

21

The members of our compensation committee are Messrs. Florence

Swette and

Rodriguez,Swette, with Mr. Florence serving as chairperson of the committee. The Board has determined that each of these members is a “non-employee director” as defined in Rule 16b-3 under the Exchange Act and is an “outside director” as that term is defined in Section 162(m) of the Internal Revenue Code of 1986, as amended.

While we are relying on the phase-in schedule permitted by the NYSE listing rules relating to compensation committee member independence, theThe Board has

also determined that Messrs. Florence and Swette are independent under the applicable rules and regulations of the

NYSE.NYSE relating to compensation committee member independence. A current copy of the compensation committee charter is available in the “Corporate Governance

—– Governance Documents” section of our website at investors.care.com.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee’s responsibilities include:

·

identifying individuals qualified to become board members;

·

recommending to the Board the persons to be nominated for election as directors and to each of the Board’s committees;

·developing

reviewing and assessing, from time to time, the adequacy of our Corporate Governance Guidelines and recommending

any proposed changes to the

Board a set of corporate governance guidelines and principles;·Board;

overseeing the annual evaluation of the Board; and

·

reviewing and evaluating, at least annually, the nominating and corporate governance committee charter and the committee’s performance.

The members of our nominating and corporate governance committee are Messrs. Miller and

Rodriguez,Florence, with Mr. Miller serving as the chairperson of the committee. Each of these members is an independent director under the applicable rules and regulations of the NYSE relating to nominating and corporate governance committee independence. A current copy of the nominating and corporate governance committee charter is available in the “Corporate Governance

—– Governance Documents” section of our website at investors.care.com.

Meetings of the Board of Directors, Board and Committee Member Attendance and Annual Meeting Attendance

The Board met

seventhirteen times during the last fiscal year. The audit committee met

threesix times,

and the compensation committee met

threefive times

duringand the

last fiscal year. We did not have a standing nominating and corporate governance committee

at anymet one time during the last fiscal year. During the last fiscal year, each

incumbent board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served. We encourage all of our directors and nominees for director to attend the Annual Meeting; however, attendance is not mandatory.

One director attended the 2015 annual meeting of stockholders.

The nominating and corporate governance committee is responsible for reviewing with the Board, on an annual basis, the appropriate characteristics, skills and experience required for

22

Table of Contents

the Board as a whole and its individual members. To facilitate the search process, the nominating and corporate governance committee solicits current directors and executives of the Company for the names of potentially qualified candidates or asks directors and executives to pursue their own business contacts for the names of potentially qualified candidates. The nominating and corporate governance committee may also consult with outside advisors or retain search firms to assist in the search for qualified candidates, or

consider director candidates recommended by our stockholders. Once potential candidates are identified, the nominating and corporate governance committee reviews the backgrounds of those candidates, evaluates candidates’ independence from the Company and potential conflicts of interest and determines if candidates meet the qualifications desired by the committee of candidates for election as director.

In evaluating the suitability of individual candidates (both new candidates and current Board members), the nominating and corporate governance committee, in recommending candidates for election, and the Board, in approving (and, in the case of vacancies, appointing) such candidates, may take into account many factors, including: personal and professional integrity, ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company; finance experience; experience relevant to the Company’s industry; experience as a board or executive officer member of another publicly held company; diversity of expertise and experience in substantive matters pertaining to the Company’s business relative to other board members; diversity of background and perspective, including with respect to age, gender, race, place of residence and specialized business or career experience relevant to the success of the Company; and practical and mature business judgment, including the ability to make independent analytical inquiries. The Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas. In determining whether to recommend a director for re-election, the nominating and corporate governance committee may consider the director’s past attendance at meetings and participation in and contributions to the activities of the Board.

Stockholders may recommend individuals to the nominating and corporate governance committee for consideration as potential director candidates by submitting the names of the recommended individuals, together with appropriate biographical information and background materials, to the nominating and corporate governance committee, c/o Corporate Secretary, Care.com, Inc.,

201 Jones Road, Suite 500,77 Fourth Avenue, 5th Floor, Waltham, Massachusetts 02451. In the event there is a vacancy, and assuming that appropriate biographical and background material has been provided on a timely basis, the nominating and corporate governance committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Stockholders also have the right under our bylaws to directly nominate director candidates, without any action or recommendation on the part of the

nominating and corporate governance committee or the Board,

23

Table of Contents

by following the procedures set forth in the advance notice provisions of our bylaws and within the timing guidelines above under the caption “When are stockholder proposals due for next year’s annual meeting of stockholders?”

Stockholder

Nomination and Standstill Agreement and Appointment of Chet Kapoor to the Board of Directors

On March 11, 2016, in connection with the election of Chet Kapoor to the Board, we entered into an agreement (the “Agreement”) with Tenzing Global Management LLC, Tenzing Global Investors LLC, Tenzing Global Investors Fund I LP and Mr. Kapoor (collectively, “Tenzing Global”), pursuant to which we agreed to recommend that the Board appoint Chet Kapoor as a Class III director and take the necessary actions to recommend that the stockholders of the Company vote for Mr. Kapoor for election as a director of the Company at the Annual Meeting.

Pursuant to the Agreement, Tenzing Global agreed that until the date which is 45 days prior to the deadline of the submission of stockholder nominations for our 2019 annual meeting of stockholders (the “Standstill Period”), Tenzing Global will not, among other things, (i) nominate any person for election as a director in furtherance of a contested solicitation, or otherwise bring any business or proposals before a stockholders’ meeting; (ii) acquire in excess of 15% of our then outstanding shares of our common stock or (iii) seek, propose, or make any proposal relating to a merger, acquisition or other type of business combination for the Company. Until the expiration of the Standstill Period, Tenzing Global will vote all of the shares of our common stock it beneficially owns (i) for the election of each of our director nominees and (ii) otherwise in accordance with the Board’s recommendation on any proposal not related to any business combination transaction involving the Company, its subsidiaries or its business. Tenzing Global has further agreed that, if at any time Tenzing Global beneficially owns, in the aggregate, less than 3.0% of our then outstanding

shares of common stock, Mr. Kapoor will immediately offer to resign from the Board and all applicable committees thereof and will so resign if the Board accepts his resignation.

A more detailed summary and copy of the Agreement can be found in the Company’s Current Report on Form 8-K filed with the SEC on March 17, 2016.

Communications with the Board of Directors

Stockholders and all other interested parties who wish to communicate directly with the Board, the Chairman of the Board, the lead independent director, all non-management directors as a group, or an individual director should address such communications to: Board of Directors, c/o Corporate Secretary, Care.com, Inc., 77 Fourth Avenue, 5th Floor, Waltham, Massachusetts 02451.

The Board will give appropriate attention to written communications that are submitted by stockholders

or other interested parties and will respond if and as appropriate. The

chairmanchairperson of the nominating and corporate governance committee, subject to the advice and assistance of our general counsel, is primarily responsible for monitoring communications from stockholders and

other interested parties and for providing copies or summaries to the other directors as he or she considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the

chairmanchairperson of the nominating and corporate governance committee considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we receive repetitive or duplicative communications.

Stockholders who wish to send communications on any topic to the Board should address such communications to: Board of Directors, c/o Corporate Secretary, Care.com, Inc., 201 Jones Road, Suite 500, Waltham, Massachusetts 02451.

Compensation Committee Interlocks and Insider Participation

During our last fiscal year, the members of our compensation committee were

Patricia Nakache, Tony Florence

and Brian

Swette and Antonio Rodriguez.Swette. No member of our compensation committee during our last fiscal year is or has been a current or former officer or employee of Care.com, Inc. or had any related person transaction involving Care.com, Inc. None of our executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers served as a director or member of our compensation committee during the fiscal year ended December

28, 2013.2426, 2015.

We describe below transactions and series of similar transactions, since the beginning of our last fiscal year, to which we were and are a party, in which:

·

the amounts involved exceeded or will exceed $120,000; and

·

any of our directors, executive officers or holders of more than 5% of our common stock, or an affiliate or immediate family member thereof, had or will have a direct or indirect material interest.

Agreement with USAA

In December 2013, we entered into an alliance agreement with USAA Alliance Services, LLC, or USAA Alliance, an affiliate of United Services Automobile Association, or USAA, pursuant to which USAA Alliance has agreed to promote our services to USAA members and we have agreed to offer our services to their members at specified discounts, which vary based on the nature of the services purchased. Under the terms of the alliance agreement, we have agreed to pay USAA Alliance specified commissions in connection with the services that are purchased by USAA members under the alliance agreement. Commissions vary based on the nature of the services purchased. We made no payments under the alliance agreement in 2013 and we anticipate that our payments under the agreement in 2014 will be less than $100,000. USAA and its subsidiary USAA Casualty Insurance Company collectively own more than 5% of our common stock.

Indemnification Agreements

Our certificate of incorporation provides that we will indemnify our directors and officers to the fullest extent

permitted by Delaware law. In addition, we have entered into indemnification agreements with all of our directors and executive officers.

Executive Compensation and Employment Arrangements

For a

description of the compensation arrangements we have with our executive officers and directors, please see “Executive and Director Compensation.”

Breedlove Compensation

and Employment ArrangementsStephanie Breedlove and William Breedlove, the founders of our subsidiary Breedlove & Associates, L.L.C., or

Breedlove, are employed by us and together own more than 5% of our common stock. For the year ended December 28, 2013, we paid each of Ms. Breedlove and Mr. Breedlove total cash compensation of approximately $190,000. In March 2014, we paid each of Ms. Breedlove and Mr. Breedlove a cash bonus of $35,150 in recognition of 2013 performance.In January 2014,2015, pursuant to the terms of thean equity purchase agreement pursuant to which we acquired Breedlove in August 2012, each of Ms. Breedlove and Mr. Breedlove became entitled to the following earn-out payments of cash and shares of Series E Preferred Stock,

25

Table of Contents

which Series E Preferred Stock automatically converted into an equal number of shares of our common stock, uponwhich were paid and issued by the closingCompany in the first quarter of our initial public offering on January 29, 2014:

Name | | Cash Payment | | Series E

Preferred Stock | |

Stephanie Breedlove | | $ | 1,875,000 | | 95,639 | |

William Breedlove | | $ | 1,875,000 | | 95,639 | |

fiscal year 2015:

|

| | | | | | |

| Name | |

Cash Payment |

| |

Common Stock |

| Stephanie Breedlove | |

| $1,250,000 |

| | 95,639 |

| William Breedlove | |

| $1,250,000 |

| | 95,638 |

Employment Arrangements With Immediate Family Members of Our Executive Officers

Ronald Marcelo, the husband of Sheila Lirio Marcelo, is employed by us. For the year ended December

28, 2013,26, 2015, we paid Mr. Marcelo total cash compensation of approximately

$136,000.$161,260. In March

2014,2016, we paid Mr. Marcelo a cash bonus of

$17,000$21,500 in recognition of

2013 performance.2015 performance, and we increased the annual base salary of Mr. Marcelo to $175,000, effective February 1, 2016. We granted Mr. Marcelo an equity award comprised of restricted stock units, or RSUs, with a fair market value of $100,000 in March 2015 and an equity award comprised of RSUs and options to purchase our common stock, with an aggregate fair market value of $50,000, in March 2016. Each equity award vests as to 6.25% of the original number of underlying shares on a quarterly basis over a four-year period.

Policies and Procedures for Related Party Transactions

We have adopted a written policy for the review of any transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which we (including any of our subsidiaries) were, are or will be, a participant, the amount involved exceeds $120,000 in any one fiscal year, and one of our executive officers, directors, director nominees or 5% stockholders (or their immediate family members), each of whom we refer to as a “related person,” had, has or will have a direct or indirect material interest.

The policy will callcalls for such transaction, arrangement or relationship, which we refer to as a “related person transaction,” to be reviewed and, if deemed appropriate, approved by the audit committee of the Board. Whenever

practicable, the reporting, review and approval will occur prior to entry into the transaction. If advance approval of a related person transaction requiring the audit committee’s approval is not feasible, then the transaction may be preliminarily entered into by management upon prior approval of the transaction by the chairperson of the audit committee subject to ratification of the transaction by the audit committee at the committee’s next regularly scheduled meeting. If the transaction is not so ratified, the policy will require management to make all reasonable efforts to cancel or annul such transaction. Any related person transactions that are ongoing in nature will be reviewed annually.

A related person transaction reviewed under the policy will be considered approved or ratified if it is authorized by the audit committee after full disclosure of the related person’s interest in the transaction. In reviewing and approving any such transactions, the audit committee will be tasked to consider all relevant facts and circumstances, including but not limited to whether the transaction is on terms comparable to those that could be obtained in an arm’s length transaction and the extent of the related person’s interest in the transaction.

All of

The Breedlove earn-out payments described above were made pursuant to the

transactions described in this section occurredBreedlove equity purchase agreement, which was entered into prior to the adoption of the policy.

26